Buying a home isn’t just a financial decision it’s a lifelong dream For many, it’s the result of years of saving and planning. But with so many factors like budget, loans, legal documents, and location choices, the process can seem complicated. Whether you’re a first-time home buyer, looking to invest in a flat in Jaipur, or planning to purchase a house in another state/city, understanding every step before you start can save you time, stress, and money.

That’s why Search Abode brings you a complete, easy-to-follow guide covering everything from planning your budget and checking required documents to understanding the legal process and finding the right property in your city.

Contents

- Why Buying a Home in India Matters & Where to Start

- Steps to Buy a Property in India

- Special Situations & Location-Specific Notes

- Government Support & Subsidies for First Time Home Buyers

- Your Personal Checklist : The Essential Checklist for Buying Your First Home in India

- Conclusion : Take Command of Your Home Buying Journey

Why Buying a Home in India Matters & Where to Start

The Benefits of Home Ownership

- Stability & security: Owning your home means you’re not subject to rent increases or landlord decisions.

- Forced savings and equity building: Monthly payments build your stake rather than someone else’s.

- Long-term investment potential: Real estate in India tends to appreciate over time (though with risks).

- Pride & personalisation: You can customize your home as you like.

- Government incentives: For example, subsidies under schemes like Pradhan Mantri Awas Yojana (PMAY) reduce the cost of buying for eligible buyers.

First Time Home Buyer Guide

Before you even look at listings, get your finances and mindset ready.

- Assess your current income, savings, liabilities. sbirealty.in

- Check your credit score (CIBIL or equivalent); good credit helps you get better home loan terms.

- Work out how much you can afford: down-payment, EMIs (equated monthly instalments), maintenance costs, stamp duty, registration.

- Decide your timeline and goal: Do you want to plan to buy a house in 5 years? Then start saving and investing accordingly.

What’s the Real Cost of Buying a Home

Underestimating the cost is a common trap. Consider:

- The property cost itself

- Down payment (~10-25 % of cost often in India)

- Home loan interest & tenure

- Stamp duty, registration charges, transfer fees

- Legal fees, agent fees, brokerage (if any)

- Maintenance, society charges, property tax, insurance

- For low-income or “how to buy a house with no money in India” buyers: you may need to build up savings, use subsidies or join schemes.

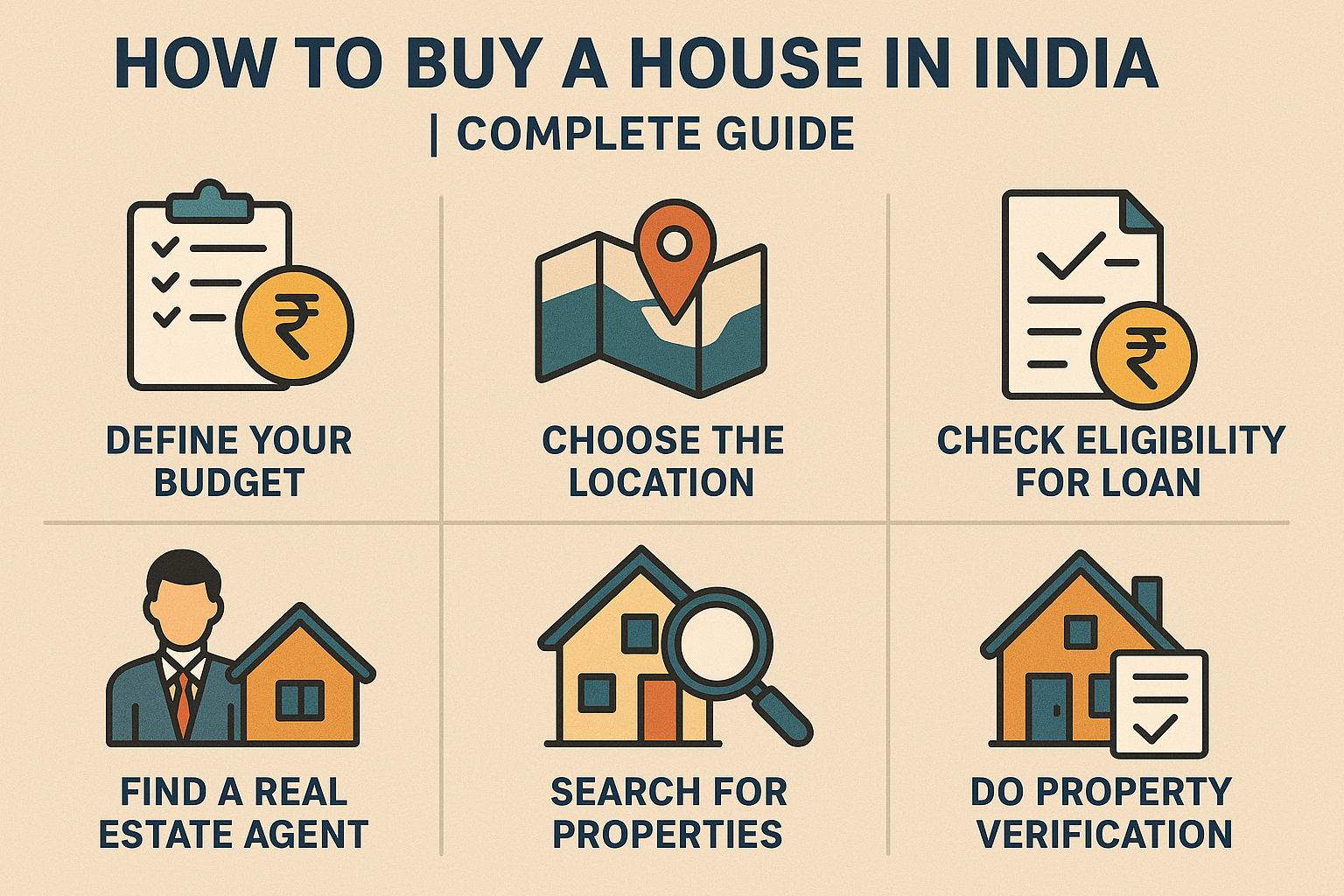

Steps to Buy a Property in India

Below is a practical, chronological checklist to follow. Each step includes the key tasks you must complete.

1 Step : Set Your Budget & Get Pre-approved

- Determine your total budget: how much you can pay now, how much you’ll borrow.

- Go to banks / NBFCs and get pre-approval of home loans. This strengthens your bargaining position.

- For low income buyers: choose smaller properties, consider joint loans with spouse, use subsidy schemes.

- Planning to buy a house in 5 years? Start a savings fund now, invest conservatively to build your down-payment.

2 Step : Choose the Right Location & Property Type

- Decide city/area: e.g., how to buy property in Jaipur, how to buy a house in Mumbai.

- Locality matters for resale and lifestyle. Look at connectivity (metro/bus), schools, hospitals, amenities.

- New vs resale, apartment vs house, builder vs owner sale (properties for sale in Jaipur by owner)

- For Jaipur: check up-and-coming areas, infrastructure projects, and compare “flat buy in Jaipur” vs “house buy in Jaipur”.

3 Step : Do the Legal Due Diligence & Documents Required

- Verify title of land/property, check if seller has legal right to sell.

- Key documents required to buy property in India: identity proof, income proof, tax returns, bank statements, property papers (sale deed, encumbrance certificate), building approvals, RERA registration (if applicable).

- For buying in states like Bangalore or Jaipur: also check state-specific documents (documents required to buy property in Bangalore).

- Legal process of buying a house in India: stamp duty payment, registration, execution of sale deed.

4 Step : Finalise Financing (Home Loan, Subsidies)

- Compare home loan interest rates, tenure, pre-payment terms.

- Subsidy schemes: For first time home buyers in India, schemes like PMAY offer interest subsidy under certain income/eligibility.

- “How to buy a house with no money in India” or with low income: you may rely more on subsidy + small down payment + choose lower cost property.

- Mortgage (home loan) becomes a long-term commitment to ensure EMIs are comfortable for your budget.

5 Step : Negotiation & Closing the Deal

- Once you pick a property: negotiate price, payment schedule (especially if under-construction).

- Agree on booking amount, token money, timeline for handover.

- Ensure builder/developer has all approvals if under-construction; if resale, ensure all dues cleared by seller.

- Sign agreement/sale deed, pay stamp duty, register property. Transfer ownership.

6 Step : Move in & Post Purchase Checklist

- After registration and handover, collect possession letter, occupancy certificate (if applicable)

- Pay society maintenance, apply for utilities (electricity, water)

- Keep all property and loan documents safely for resale/loan transfer in future.

- Budget for long-term costs like property tax, insurance, periodic maintenance.

- Planning to buy a house in 5 years: start improving/maintaining it so resale value is higher.

Special Situations & Location-Specific Notes

How to Buy a House With No Money in India / Low Income

- Save aggressively and early: start a small savings plan targeting down payment over 3-5 years.

- Choose affordable locations or smaller units (studio/1BHK) to start.

- Use government subsidy schemes (PMAY etc) if eligible.

- Consider co-ownership or joint loan with family/spouse.

- Plan timeline: e.g., “how to plan to buy a house in 5 years” means you give yourself time.

- Stay clear of properties that look cheap but may have high maintenance or legal issues.

How to Buy Property in Jaipur / Flat Buy in Jaipur

- Jaipur is an emerging market: “property for sale in Jaipur”, “flat in Jaipur for purchase”, “house buy in Jaipur”.

- Choose locality with good infrastructure, upcoming metro/road projects.

- If buying “by owner” in Jaipur (property for sale in Jaipur by owner), ensure legal check thoroughly.

- Compare ready-to-move vs under-construction: ready reduces risk but may cost more.

- Ensure RERA registration (since state RERA applies) and building approvals.

Buy a Property in Mumbai

- Mumbai is one of the most expensive markets: high land cost, high premium; location and connectivity are critical.

- Consider suburban areas with infrastructure projects coming up.

- Verify project status, builder’s track record, delays, possession issues (many Mumbai projects delayed).

- Factor cost of commuting, maintenance and higher property tax.

Documents Needed to Buy Property / Documents Required to Buy a Property in India

- Identity and address proof (Aadhar, passport, voter ID)

- PAN card

- Income proof (salary slips, Form 16)

- Bank statements, savings, investments

- Property documents: title deed, encumbrance certificate, survey map, building plan, approved layout, building completion certificate/occupancy certificate.

- Home loan documents: sanction letter, no-objection certificates, etc.

- For flats/apartments: share certificate, society approval, maintenance details.

- These documents vary slightly state-to-state (e.g., for Bengaluru: “documents required to buy property in Bangalore”).

Government Support & Subsidies for First Time Home Buyers

What Subsidy Schemes Exist?

- PMAY (Urban & Gramin) offers interest subsidies for eligible home buyers in lower/middle income groups.

- Many state governments have schemes for first-time home buyers (check state wise).

- Developer or bank schemes: sometimes low-cost housing or special loans for first time buyers.

How to Qualify for a Subsidy

- Income category: EWS, LIG, MIG etc. (eligible income limits apply)

- Property cost ceilings: subsidy only up to a certain value of home.

- You should not already own a home (some schemes require you to be a first-time buyer).

- Loan must be from an approved bank/HFC under scheme.

- Submit required documents and apply through the official portal/approved channel.

Common Mistakes to Avoid

- Buying beyond your budget: EMIs too high, leaves you financially stretched.

- Not doing legal due diligence: leads to title disputes, delays, hidden costs.

- Ignoring total cost (maintenance, tax, society charges).

- Rushing into “cheap houses” without checking infrastructure or resale potential.

- Not comparing home loan offers, missing better interest rates.

- For first time buyers: thinking property automatically always appreciates market, location & timing matter.

Your Personal Checklist : The Essential Checklist for Buying Your First Home in India

Quick-Tick Checklist

- Budget defined with down payment + EMIs + buffers

- Credit score checked and home loan eligible

- Location shortlisted (city/area)

- Property type decided (flat/house, new/resale)

- Legal verification: title deed, RERA, approvals

- Documents ready: ID, income proof, bank statements

- Home loan offers compared + subsidy eligibility checked

- Negotiation done: price, payment schedule

- Sale deed executed, stamp duty registered

- Possession taken, utilities connected, post-purchase costs planned

Conclusion : Take Command of Your Home Buying Journey

Buying a home is not just about finding the right property, it’s about making the right plan, understanding your finances, doing your legal homework, and choosing a property and location that will serve you well for years. Whether you are searching for “flat in Jaipur for purchase”, “house buy in Jaipur”, or planning to buy in Mumbai, the fundamentals remain the same. Use this guide from Search Abode as your roadmap and go step-by-step. If you plan to buy a house in 5 years, start today. Your future self will thank you.

How to Buy a Home: Complete Guide

A: It depends on location, size, type. In addition to price, add stamp duty, registration, legal fees, loan fees. Also ongoing costs like maintenance, property tax.

A: Yes, by choosing a smaller/affordable property, using subsidies, having a co-borrower, and ensuring EMIs fit comfortably.

A: Not necessarily. With a home loan and down payment + subsidy, many buyers purchase with lower upfront funds. However, you must cover down payment, charges, and have buffer.

A: After finalising, sign an agreement, pay booking amount, verify documents, execute sale deed, pay stamp duty/registration, and transfer ownership

A: Verify seller’s legal status, check RERA registration of project, review locality, infrastructure, and ensure no hidden charges or delays.

- Top Home Buyer Mistakes in India & How to Avoid Them (2026 Guide)

- How to Compare Home Loan Options in India (Guide 2026)

- Real Estate Investment Strategies for First Time Investors in India (2026 Guide)

- Complete Checklist Before Finalizing a Property Booking

- Fractional Ownership in Real Estate: A Smart Investment Model

- Property Tax in Jaipur: Charges, Rules & Buyer Guide